Table of Contents

In today’s world, filled with ads and social media, it’s important to tell the difference between what we need and what we want (needs versus wants). It can be tough because everything looks so tempting! In this article, we’ll check out 11 clear examples of needs versus wants in personal finance. This will help you get better at spending your money and making smart choices that match your real financial goals. Whether you’re saving for a rainy day or trying to stick to your budget, these examples will help you see what really matters when it comes to managing your money wisely.

In the Philippines, handling your personal finances can feel like trying to find your way through a tricky maze. Think about it like standing at a crossroads: one way leads to things you absolutely need for survival and stability, while the other tempts you with cool gadgets and fancy experiences that might bring joy but could leave you broke. This big difference affects how we spend money every day, from buying groceries to planning for vacations.

Here is a list of 11 examples of needs versus wants in personal finance:

Needs Versus Wants Sample #1. Housing (Need) vs. Luxury Apartment (Want)

When finding the perfect place to live, it’s super important to understand the difference between what you need and what you want. A basic home gives you the safety and stability you need, but it’s easy to get tempted by fancy apartments with cool amenities like pools and gyms. It’s totally cool to dream about living in a high-rise with amazing city views, but it’s also smart to think about whether that’s the best choice for your long-term financial goals.

Deciding between a modest home that meets your needs and a super fancy apartment can make a big impact on your overall financial health. Going for a more affordable option gives you the freedom to save money for other important stuff like education and healthcare. And hey, focusing on what you need instead of what you want can help you become a budgeting pro and bring more contentment into your life. Choosing simplicity often leads to more happiness than chasing after fleeting luxuries.

Needs Versus Wants Sample #2. Groceries (Need) vs. Eating Out at Restaurants (Want)

It’s important to understand the difference between buying groceries, which is a necessity, and dining out, which is more of a want, when managing your money in the Philippines. Buying groceries is essential for keeping you fueled and healthy while eating out is more about having fun and socializing. Although treating yourself to a meal out can be really enjoyable, it’s crucial to remember that it’s not as essential as maintaining your financial stability.

Balancing needs versus wants requires conscious decision-making. To stretch your budget further, consider meal prepping using affordable grocery items that reflect your dietary preferences. This approach saves money and encourages creativity in cooking while fostering healthier eating habits. By strategically prioritizing grocery shopping over frequent dining out, you can build more robust financial foundations and even reserve occasional splurges on restaurant meals as treats rather than regular habits—allowing you to enjoy health and happiness without compromising your fiscal goals.

Needs Versus Wants Sample #3. Basic Clothing (Need) vs. Designer Clothes (Want)

When navigating the complex world of personal finance, distinguishing between needs versus wants can bring clarity to your spending habits. Basic clothing falls firmly into the category of needs; it serves a fundamental purpose in providing protection and comfort. In the Philippines, where the weather can be quite unpredictable, having a versatile wardrobe with essentials like comfy tees, durable pants, and reliable footwear is really important for your day-to-day activities. Having these kinds of versatile clothing options means you’ll always be ready for whatever the day brings, whether it’s work or leisure, without stressing about what to wear.

On the other hand, designer clothes are all about luxury, and while it’s great to treat yourself every now and then with a high-end item that reflects your personal style and achievements, it’s important to be mindful of going overboard. Finding that balance requires self-awareness and discipline; putting money aside for savings or investments instead of splurging on expensive clothes can lead to greater long-term rewards.

Ultimately, embracing quality basics helps you create a sustainable wardrobe while still allowing you to enjoy a touch of luxury without putting your financial well-being at risk.

Needs Versus Wants Sample #4. Transportation (Need) vs. New Car with Premium Features (Want)

When considering transportation in the context of needs versus wants, it’s crucial to recognize that while having reliable transportation is a fundamental necessity for daily living—be it commuting to work, running errands, or attending social engagements—the allure of a new car with premium features often ignites our desires. A dependable vehicle ensures we can meet obligations and navigate life’s demands, but as we dream about top-tier sound systems, advanced safety features, and luxurious interiors, it’s essential to evaluate how these desires influence our financial choices.

Just picture yourself at a point where you have to make a choice between getting a practical car or splurging on a fancy one with all the bells and whistles. While it’s so tempting to go for the luxurious option, sometimes it’s better for your long-term goals to go for the more practical choice. It’s all about understanding what you really need versus what you want. By making informed decisions like this, we can set ourselves up for a prosperous future while still enjoying life.

Needs Versus Wants Sample #5. Health Insurance (Need) vs. Cosmetic Procedures (Want)

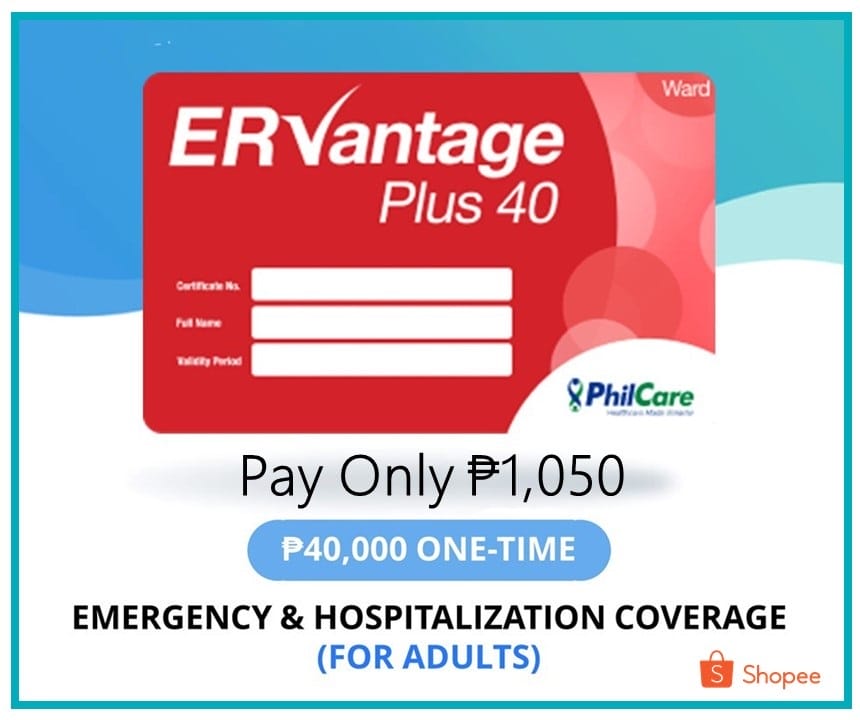

When thinking about personal finance, it’s important to distinguish between needs versus wants when it comes to health insurance and cosmetic procedures. Health insurance is a must-have, providing a safety net against unexpected medical expenses. It covers hospital visits, emergency care, and preventive services essential for long-term well-being. For many Filipino students and workers dealing with rising healthcare costs, having robust health insurance isn’t just beneficial—it’s necessary for peace of mind and security.

On the other hand, cosmetic procedures are more of a want. While they can boost self-esteem and appearance, they often come with hefty price tags that can strain finances unnecessarily. It’s crucial to consider whether spending on aesthetics takes away from more critical financial commitments like securing adequate health insurance or saving for emergencies. By focusing on needs versus wants in this area, individuals can better prioritize their resources—investing first in what safeguards their health and understanding that beauty enhancements can wait until after they’ve built a solid financial foundation.

Needs Versus Wants Sample #6. Utilities (Need) vs. Smart Home Devices (Want)

Understanding the difference between things you really need (like utilities) and things you want (like smart home devices) is important when managing your money, especially for lots of people in the Philippines as technology keeps changing. Things like electricity, water, and the internet are must-haves for everyday life, while cool gadgets for your home, like smart speakers and automated lights, can make it hard to tell what’s a necessity and what’s just a luxury.

When you compare what you need to what you want, it’s best to think about your long-term budget. Investing in utilities makes sure you cover your basic needs first and stay safe and connected. On the other hand, focusing on spending money on smart home tech can make you spend more than you should if it means you forget about what you really need. Thinking carefully about whether a gadget really makes your life better, rather than just making things more convenient, can help you make smart choices with your money and make sure you’re staying on track with your goals and keeping your everyday life stable.

Needs Versus Wants Sample #7. Essential Healthcare Products (Need) vs. Wellness Retreats or Spas (Want)

When managing your money, it’s essential to figure out what you really need versus want, especially when it comes to taking care of your health. Things like medicine, medical equipment, and health insurance are totally essential for keeping us healthy and safe. Not having them can cause some serious problems.

On the other hand, things like spa treatments or wellness vacations are more about what we want, not what we need. They’re great for relaxing and reducing stress, but they aren’t essential for our health. By understanding this difference, Filipinos can make better choices about where to spend their money. Investing in preventive care or getting medical help when we need it can actually have way more long-term benefits compared to spending money on fancy spa trips.

It’s not just about spending less; it’s about making smart choices that help our physical and mental health in a way that we can maintain over time.

Needs Versus Wants Sample #8. Education Expenses for Essential Skills (Need) vs. Extravagant Courses or Certifications in Hobbies (Want)

In personal finance, it becomes crucial to differentiate between educational expenses aimed at essential skills (needs) and those focused on hobbies or indulgent certifications (wants). When Filipinos invest in courses that enhance their career prospects—such as computer programming, digital marketing, or language proficiency—they’re not just spending money; they are laying the groundwork for future earning potential. These educational investments often lead to promotions, improved job stability, and enhanced qualifications in an increasingly competitive job market.

On the other hand, spending on luxurious courses in niche hobbies like gourmet cooking or specialized art techniques may seem alluring but raises important questions about long-term return on investment. While these classes can bring joy and creativity, it’s crucial to consider whether they truly align with your immediate financial goals or divert attention from pressing economic realities. Ultimately, this differentiation between needs versus wants helps Filipinos make informed choices that safeguard their well-being and future aspirations—ensuring that every peso spent is a step towards financial freedom rather than mere indulgence.

Needs Versus Wants Sample #9. Savings for Emergencies (Need) vs. Vacation Fund for Luxury Travel (Want)

When navigating through personal finance, understanding the distinction between needs versus wants becomes crucial, especially in savings. On one hand, an emergency fund is a fundamental need. It acts as a financial safety net during unforeseen circumstances like medical emergencies or job losses. Filipinos often face unexpected expenses that can disrupt daily life and cause significant stress. Having a robust emergency fund ensures peace of mind and long-term stability, allowing you to respond decisively when these challenges arise.

On the other hand, setting aside funds for luxury travel embodies the want aspect of personal finance. While exploring beautiful beaches or indulging in fine dining may provide joy and relaxation, they don’t address immediate survival needs. That said, cultivating a balanced approach can enhance your overall well-being; allocating money for leisure activities after securing your necessities can lead to a more fulfilling life experience. It’s about finding harmony—meeting essential obligations while still making room for enjoyment without sacrificing security. By clearly defining your priorities within this “needs versus wants” framework, you establish stronger financial health supporting resilience and happiness.

Needs Versus Wants Sample #10. Internet Service for Work and Study Purposes (Need) vs. High-Speed Internet Package with Extra Features (Want)

In today’s digital age, navigating personal finances can be complex, especially when it comes to distinguishing between needs versus wants. For many Filipinos working or studying from home, having reliable internet service is a necessity for communication, access to essential resources, and seamless collaboration. Basic internet packages should be seen as a crucial investment for productivity and learning, rather than just an expense.

On the other hand, high-speed internet packages often come with enticing extras like streaming services and enhanced customer support. While these features may seem appealing, they are more aligned with desires than necessities. Although they may promise a better online experience and provide some entertainment benefits, allocating funds to these premium features could take away from more critical areas of budgeting.

Prioritizing fundamental internet service over extravagant upgrades can help individuals maintain their financial stability while still addressing their core connectivity needs. It’s essential to find a delicate balance between meeting genuine necessities and indulging in luxury enhancements without losing sight of long-term financial goals.

Needs Versus Wants Sample #11. Basic Cell Phone Plan (Need) vs. Latest Smartphone Model with All Upgrades (Want)

Navigating personal finance can be a bit tricky with so many tempting things around us, especially in today’s fast-paced digital world. Having a basic cell phone plan is super important as it helps us stay connected with our loved ones and take care of work stuff. It’s got all the essential features like calling and text messaging, and just enough data for our daily needs without costing too much. This way, we can handle our personal stuff without worrying too much about money.

On the other hand, there’s the appeal of the latest, fancy smartphone model with all the amazing upgrades—like top-notch cameras, tons of storage, and super-fast processors. While it’s tempting, it’s more of a want than a need. It might make us spend way more on things that might not really make a big difference in our everyday life. Understanding this difference can help us prioritize our spending better. It lets us stay financially stable and avoid getting caught up with the pressure of following trends that make us spend more on things we don’t really need. By focusing on what we really need over what’s tempting, we can set ourselves up for better financial health and satisfaction in the long run.

Defining Needs in Personal Finance

Understanding the difference between needs versus wants is crucial for managing money wisely, especially given the constantly changing world. Needs are the things we really need to live—like food, housing, education, and healthcare—and are essential for our well-being and survival. On the other hand, wants are the things that make life more enjoyable but aren’t necessary for survival, like fancy gadgets or luxury items.

Sometimes it’s hard to tell the difference because ads are always persuading us to want more things. For example, we might think we really need the latest smartphone, but we could reconsider if our current one still does the job. By focusing on what we really need instead of what we want at the moment, we can use our money more wisely and save for important things like education or buying a home. Understanding the distinction between needs and wants helps us make better financial choices and work toward long-term security and happiness.

Defining Wants in Personal Finance

Hey there! Understanding the difference between needs versus wants is essential when it comes to managing your money. Needs are the things you absolutely have to have to live, like food, shelter, and healthcare. Then there are wants, which are all the extra things that make life fun, like buying gadgets, going out to eat, or getting new clothes. This difference not only helps with budgeting but also shapes our spending habits and what we prioritize.

But what if we thought of some wants as things that could actually be needs? Take experiences, for example. They might seem like wants, but they can create lasting memories and help us grow as people. By thinking about certain wants in a different way, we can improve our quality of life while still being responsible with our money. This kind of thinking can help us become smarter with our money and better at managing it. Seeing needs versus wants in a new light can help us build a financially secure future without sacrificing happiness or fulfillment.

Tips for Filipinos on Balancing Needs Versus Wants

It’s super important for Filipinos to know the difference between their needs versus wants when it comes to managing their money. One useful tip is to follow the 80/20 rule when planning your budget: put 80% of your income into essential stuff like housing, food, and education, and keep 20% for fun things like eating out or entertainment. This way, you can take care of your basics while still treating yourself without messing up your money goals.

Also, trying to be more mindful about what you buy can really help you figure out what you really need versus just wanting something at the moment. Before you buy something, ask yourself if it’s something that’ll actually add value to your life or if it’s just a passing fancy. And it’s good to practice waiting before you buy something non-essential; if you wait a few days, you might find that you don’t really need it after all. This gives you a chance to think about what’s really important for your long-term happiness and money situation.

Here’s a YouTube video that might help you understand, click here.

Wrapping Up: 11 Examples of Needs Versus Wants in Personal Finance (Tips for Filipinos)

Understanding the difference between needs and wants is essential for effective personal financial management, particularly in the Filipino context, where cultural subtleties can often blur these distinctions. For example, while students need a basic smartphone to attend online classes and stay in touch with family, spending on the latest model can easily become a want. Recognizing what truly supports your financial stability, such as health insurance or essential groceries, is crucial because it allows you to prioritize spending that contributes to long-term security rather than immediate gratification.

Additionally, adopting a mindset that distinguishes between needs and wants enables individuals to make deliberate financial decisions about budgeting and saving. By viewing purchases through this filter, Filipinos can redirect funds into savings or investments that improve future prospects. This transition not only results in healthier finances but also fosters an appreciation for what one already has, promoting contentment in the face of societal pressures to keep up with current trends and lifestyle expectations. Embracing this balance ultimately sets the stage for more meaningful financial choices rooted in values rather than passing desires.