Table of Contents

It’s important to know how to compute income tax in the Philippines, especially if you are an individual or business owner. This guide will teach you how to use the BIR Tax Calculator 2022, how to compute income tax for businesses in the Philippines, and how to compute income tax for individual taxpayers.

What is the BIR Tax Calculator 2022?

The BIR Tax Calculator 2022 is a government website that helps you calculate your income tax for the year. You can use this calculator to find out your gross income, net income, and withholding tax.

Try to enter your salary on the tax calculator below to compute your personal income tax.

How To Compute Income Tax (Business) In The Philippines

To calculate income tax for business in the Philippines, first you must calculate your gross income. To do this, you will need to enter your total income from all sources (employee salaries, self-employment income, capital gains, etc.). You will also need to add any deductions you are eligible for (such as depreciation, etc.). After you have entered all of your information, you will be able to see your net income.

How To Compute Income Tax (Personal Taxpayers) in the Philippines

To calculate income tax for individual taxpayers, you will first need to determine your taxable income. This taxable income will include your gross income as well as any deductions you are eligible for (such as the personal exemption, etc.). After you have determined your taxable income, you will then need to subtract your personal exemption from this number. This leftovers is your taxable income. You will then need to calculate your income tax using the withholding tax rates provided on the BIR Tax Calculator 2022.

How to compute income tax in the Philippines

Income tax in the Philippines is a complex process that can be difficult to understand. However, with a little knowledge and some simple steps, you can easily compute your income tax and ensure that you are paying the correct amount. In this article, we will walk you through the basics of computing your income tax in the Philippines. We will cover the different types of income tax, as well as the methods for calculating your tax liability. We will also provide some example calculations to help you understand the process.

Step 1: Base on your salary per month, get your taxable income figure.

Income tax in the Philippines is levied by the Bureau of Internal Revenue (BIR). The basic tax rate is 25 percent, but there are several other rates that apply to different income brackets. For single individuals, the taxable income range starts at Php150,000 and goes up to a Php1 million. For married couples filing jointly, the taxable income range starts at Php300,000 and goes up to a Php4 million. The BIR also imposes a 10 percent value-added tax (VAT) on all taxable incomes. As of 2012, there are eleven personal income brackets for employees: 1-5 workers; 6-10 workers; 11-20 workers; 21-30 workers; 31-40 workers; 41 or more workers. Taxable incomes in these brackets are as follows:

1 worker: from Php12,500 to Php25,000

2 workers: from Php25,001 to Php50,000

3 workers: from 50,001 to 1000000

4+workers: from 1000000 to 3000000

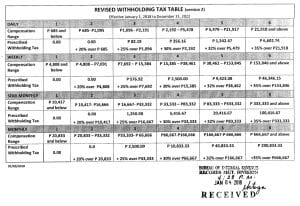

Step 2: Look into the income tax above and determine your salary column.

The Philippine income tax table is a great place to start when trying to compute your own income tax. The table lists basic incomes as well as taxable incomes. The taxable income includes salary, pension, dividends, interest, and other forms of income.?

To find your salary column in the table, look at the row that corresponds to your annual gross salary.? This will give you the amount of taxes that you’ll need to pay on that particular income.? If you’re not sure how much your annual gross salary is, use our online calculator to get an estimate.?

After you’ve determined the amount of taxes that you’ll need to pay on your salary, it’s time to fill out Form No. 1 (the individual’s return) and Form No. 2 (the employer’s return).? Both forms have detailed instructions on how to calculate various tax amounts.? Make sure you have all of the necessary documents handy when completing these forms.? If there are any questions about whether or not a particular expense is taxable or if there are any mistakes on your Forms Nos. 1 and 2, don’t hesitate to contact an accountant or tax specialist.?

Step 3: Compute your personal income tax base on your salary, taxable income and income tax rate.

Income taxes are computed based on your total income before deductions. The taxable income is the amount of your income that is subject to taxation. The tax rate is the percentage of taxable income that you will pay in taxes. Your taxable income may be different if you have other types of sources of income, such as social security benefits, pensions or capital gains.

For Pinoys Who Want to Get their Net Take Home Pay.

If you are an employee in the Philippines, your net take-home pay is your gross pay less any deductions that your employer may have made for taxes. This calculation includes mandatory and voluntary deductions such as Social Security and healthcare contributions. It also includes any employer-provided benefits, such as medical insurance or retirement savings plans.

If you are self-employed, you will need to calculate your net income using different accounting methods depending on whether you operate as a sole proprietor or in partnership with others. Regardless of the form of business, however, you should keep detailed records of everything that goes into producing your income so that you can accurately report it on tax returns.

What is Withholding Tax on Compensation in the Philippines?

Withholding Tax on Compensation is a tax that is levied on an employee’s wages and salaries. Withholding Tax is computed as a percentage of the employee’s gross pay, and it varies depending on the country of residence. In most cases, the employer must withhold tax from an employee’s paycheck and remit it to the appropriate tax authority.

What’s the Purpose of Withholding Tax on Compensation in the Philippines?

When are employers obligated to pay salaries in the Philippines?

Labor laws state that for employees paid monthly, salaries must be paid by the last working day of the month in the Philippines.

However, for daily or weekly wage earners, this may vary depending on the specific employment agreement or company policies. It is common practice for salaries to be paid on a bi-weekly or monthly basis. However, specific regulations or agreements may be in place for different types of work or industries.

As a business owner or employee, you may be wondering what the purpose of withholding tax on compensation is. Withholding tax is an important part of the income tax system in the Philippines. It helps to collect taxes from individuals and businesses who earn active or earn passive income in the Philippines.

Withholding tax is based on your taxable income and how much you are required to withhold from your compensation. The amount of withholding tax that you are required to withhold varies based on your country of residence and whether you are an individual or a corporation. The Philippine government also imposes a value-added tax (VAT) on certain goods and services that businesses may purchase from other businesses. As a result, it’s important for business owners to understand their own taxable income as well as the taxes that they will be paying.

Tax Compliance: Is it a Burden?

Compliance with taxation laws in the Philippines is a challenge. Taxpayers must file their returns on time and correctly, despite the numerous penalties that can be imposed. In addition, businesses must keep accurate records of their income and expenses to support their tax filings. This can be a significant burden for businesses and individuals, as well as a complex task for tax professionals. In terms of economic impact, compliance with taxation laws has two main effects: it reduces government revenue and it imposes costs on businesses. The first effect is primarily due to late payments or incorrect filings: when taxpayers fail to pay their taxes in a timely manner or submit inaccurate information, the government loses revenue that it would have otherwise received. The second effect is more indirect but still significant: by imposing costs on business (e.g., through lower investment), compliance with taxation laws can reduce economic growth. Overall, then, compliance with taxation laws in the Philippines has both negative (financial) and positive (economic) impacts.

Withholding Tax on Compensation Tax Rates in the Philippines

Income tax in the Philippines is computed on an individual basis, and depends on the income of the taxpayer. Withholding taxes are assessed at various levels, including social security contributions, value-added tax (VAT), and income tax. The Philippine income tax rates are progressive, with a higher rate applied to higher incomes. The current marginal personal income tax rate for individuals is 25%. There is also a corporate income tax rate of 30%.

Calculator: Withholding Tax on Compensation in the Philippines

Income tax in the Philippines is levied by the Philippine government on both personal and corporate income. Personal income is taxed at a progressive rate starting at 0% and reaching as high as 30%. Corporate income is taxed at a flat rate of 25%. Withholding tax on compensation is calculated on an individual’s gross earnings and then deducted from their total taxable income before calculating their corresponding tax liability. There are several ways to compute withholding tax, including using tables or software provided by the Department of Finance, or using a payee’s payslips.

Filing Requirements for Withholding Tax on Compensation in the Philippines

Filings for withholding tax on compensation in the Philippines are required by both employers and employees. Employers must withhold at a rate of 30% on wages paid above PHP200,000, while employees must withhold at a rate of 10% on all compensation. Additionally, certain payments made to foreign residents are subject to an additional 20% withholding tax. For most people, these filing requirements will be straightforward; however, there may be rare cases where payments or deductions made by an employer or employee fall outside the scope of the regulations. In such cases, it may be necessary to seek advice from a tax specialist.

BIR Form 2316 – Certificate of Compensation Payment / Tax Withheld or BIR

The following document is an official receipt from the Bureau of Internal Revenue (BIR) that shows the income tax and social security contributions withheld from a compensation payment. The form is used to document the income tax liability of an individual or a company.

The front of the form shows the date and time of payment, as well as the name and address of the payer. The form also has spaces for the amount paid in cash, check or money order, as well as information on whether any taxes were withheld. The back of the form has spaces for recording information such as total income, tax withheld and social security contributions paid.

If you are receiving a payment in cash, make sure to keep track of both the receipt and your bank statement to ensure that all taxes have been fully accounted for. If you are receiving a payment through a company, be sure to get a copy of their payslips so that you can track all expenses associated with this compensation payment.

Residents and non-residents

Income tax in the Philippines is computed on an individual’s total taxable income. This includes both resident and non-resident income. Resident status is determined by whether the taxpayer resides in the Philippines or not for at least 183 days during the taxable year. Non-resident status is determined by whether the taxpayer resides outside of the Philippines for at least 183 days during the taxable year.

Tax rates in the Philippines

Income tax in the Philippines is progressive with a top marginal rate of 40%. The following table shows the tax rates for different income levels:

The personal income tax system in the Philippines is based on an annual income tax return. Taxpayers must file a return regardless of whether they have taxable income or not, and regardless of whether they have any deductions. There are two types of returns: an individual return and a corporation return.

An individual who has taxable income must file an individual return, which includes all his/her taxable incomes from all sources during the year. He/she must also list all his/her deductions, which include allowances for dependents, charitable contributions, etc. A corporation that has taxable income must file a corporate return including its total taxable incomes from all sources during the year. It must also list all its deductions, which include allowances for shareholder dividends, salary paid to directors and employees, etc

Residents Tax working in the Philippines

Residents of the Philippines who are working in another country and earn income through employment must pay income tax on that income in their home country. Income tax rates vary depending on an individual’s taxable income, but in general, residents of the Philippines must pay taxes on their worldwide income at a rate of 30%. In addition, Philippine residents who are working abroad and earning a salary or wages may be subject to social security contributions and other withholding taxes.

Non-residents Tax working in the Philippines

The Philippines has a unique system of taxation that is based on the concept of fiscal sovereignty. This means that the Philippines retains full control over its economic affairs and tax system, including the collection and assessment of taxes. This allows for a wide variety of tax treatments, which can impact how taxpayers report their income and file taxes.

Certain individuals who are not residents of the Philippines are generally subject to Philippine income tax laws. This includes citizens of countries that have signed agreements with the Philippines specifying that they will be taxed under Philippine law, as well as persons who are legally residents in the Philippines but not citizens. In addition, certain foreign corporations with at least 50 percent ownership by Philippine nationals are also subject to Philippine income tax rules.

Income from working in the Philippines is generally taxable in accordance with Philippine tax laws. Most forms of income – including wages, salaries, commissions, tips, bonuses, etc – are subject to regular income tax rates ranging from 10 to 40 percent. In addition, there is a wealth tax (known as the BIR value-added tax or VAT) levied on assets above a certain value. Finally, there is a corporate income tax imposed on profits from enterprises

Types of taxable compensation in the Philippines

Income tax in the Philippines is payable by individuals and corporations on their taxable income. Taxable income is computed as gross income less allowable deductions. There are several types of taxable compensation that are subject to Philippine income tax: salary, wages, dividends, interest, rents, royalties and emoluments. Taxable compensation is also subject to social security contributions and mandatory withholding taxes.

Conclusion: How To Compute Income Tax In The Philippines

Income tax in the Philippines is a complex process that can be quite confusing for individuals. There are numerous ways to compute your income and tax burden, depending on your personal circumstances. However, the most important thing to remember is that you should always consult an accountant or tax specialist to ensure that your taxes are correctly calculated and paid.